Banking with any of Nigeria's traditional banks comes with a lot of challenges and sometimes, unnecessary sacrifices. Customers usually gets deducted a lot, this in turn reduces what such person can save.

Some of the deductions come in the form of

1. ATM card maintenance fees: This is usually deducted, no matter how much the customer has in the account, on a monthly basis.

2. Unnecessary and sudden debits: Some banks are in the habit of sudden deductions from a customer's account. The case of Innoson and GT Bank comes to mind.

However, to prevent such deductions and many more, a digital bank is needed to bridge the gap.

And I believe Rubies Bank is that bank! You want to know why? Well, in this post, I will show you why you have to bank with Rubies and how to open an account with them and actually "own your bank".

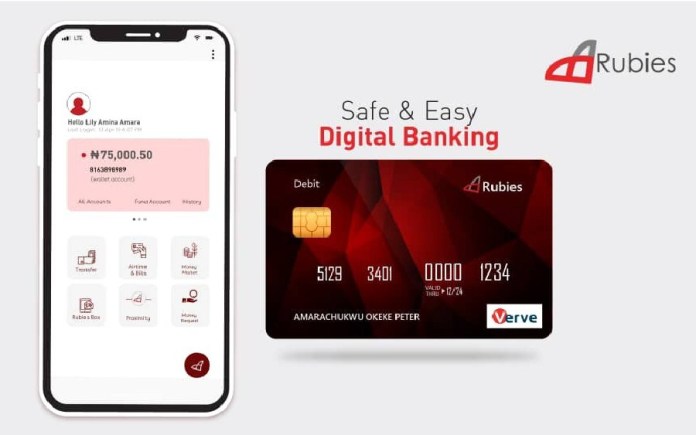

But first: WHAT IS RUBIES BANK? Rubies Bank is a fully digital banking platform, which offers ZERO FEE banking, targeting young people, especially students, and other progressionals, SMEs, quasi-financial institutions and FINTECH companies.

Rubies brings a totally different approach to banking.

Unique features of Rubies Bank

Rubies comes preloaded with very wonderful and first of its kind unique features, beating so many others on the field. The following are some of its wonderful features.

a. Personalised Account number: One of its kind! You can choose an account number that you want. This means that you can choose a combination of your date of birth or phone number, as long as it is available! Who wouldn't want that?

b. Personalised debit card delivered at zero cost: With this feature, you can add your nickname to your debit card. On top of it, it is delivered to you at ZERO COST!

c. Request money feature: For those uncles and aunties that usually give excuses, you can simply "request money" from them, which in the event they approve, you get credited instantly.

d. Proximity Transfer: With this feature, one can easily send money using BLUETOOTH!

e. Social Appeal: With this feature, you can interact with other users of Rubies Bank in the app! And you also get alerted when your buddies join Rubies.

f. Proximity feature: This allows you to see people around you. The look and feel is sleek, neat and appealing.

g. Open Banking: API-based architecture of Rubies will give it the scale it yearns. Open banking architecture allows smooth integration with FINTECH companies, SMEs and other quasi-financial institutions while Rubies serves a layer-2 Clearing function.

h. Bank-as-a-service: Rubies Technology is available for use by any other financial institutions playing in Banking, Finance, Technology and FINTECH industries, thus offering bank as a service.

Earning money with Rubies Bank

With the aim of empowering people, Rubies also introduced a feature, called Independent Marketer, whereby customers earns money marketing for Rubies.

If you are willing to run your own mini bank, Rubies serves as the platform for you to do that freely. You simply on-board your own “banking customers” using your unique link and every time your customer does a transaction, you earn money. Rubies wants everyone to take a piece of the pie.

The possibilities are endless.

It also have a Money Market feature. This is where you make money either by investing or providing money to those who need it on loan. Rubies Credit score is growing in popularity as a standard.

HOW IS RUBIES BANK DIFFERENT FROM OTHER BANKS? This question must have come across your mind several times by now. Well, let me explain.

1. Bank charges: This is one of the controversial topics right now, with banks practically cutting off the heads of their customers with serious charges, not minding how much he or she has. This is caused by huge technological costs incurred by banks, who are trying to satisfy customer's needs.

But with Rubies Bank, the cost is driven down to near zero. This makes it possible to waive charges and avoid all the “hidden” charges that traditional banks levy their customers. For interbank transactions, Rubies charges N21 (instead of N52 that traditional banks charge), this being the cost of the transaction payable to the switches, while Rubies earns nothing.

2. Technology: The technology invested in building Rubies is totally unparalleled right now. With the fast pace world of ever-growing technology, the use of artificial intelligence, data analytics and recommender systems aid to personalize each individual’s banking experience. In addition, for scalability, cloud computing allows scale, seamless customer growth as well as ensuring top-notch security.

HOW TO OPEN AN ACCOUNT

This is fairly simple. Simply click HERE or go to Google Play Store and download the app.

Requirements

1. A working email address

2. A phone number

3. Data enabled phone

How do you see this post? Remember, sharing is caring. Don't forget to share to friends!

0 Comments